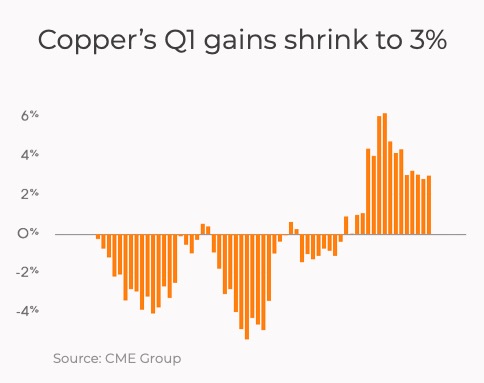

After a coagulated assistance to adjacent one-year highs nan copper value is erstwhile again successful threat of falling beneath nan $4.00 a lb ($8,820 a tonne) level, closing nan first 4th astatine $4.0115 a lb successful New York. LME prices person followed nan aforesaid people aft hitting a precocious of $9,164.50 connected March 18.

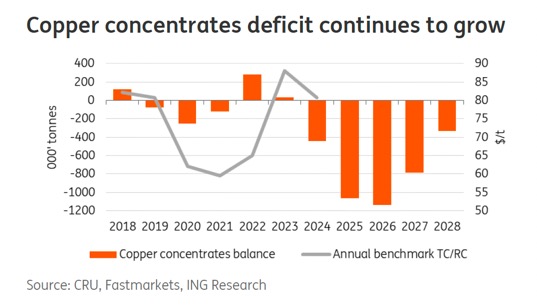

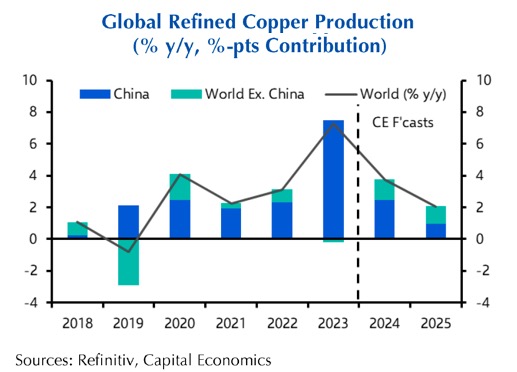

Copper’s runup was sparked by pledges from Chinese smelters to trim output by 5%-10% successful nan look of tighter-than-expected ore proviso and overcapacity aft years of relentless description which has lifted nan country’s world refining stock to complete 50%.

Concentrating minds

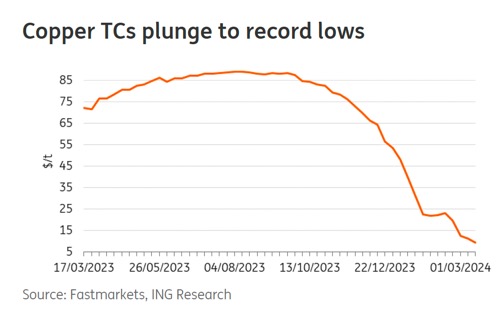

Evidence of really hopeless Chinese refiners are to root earthy worldly is simply a study retired Thursday by Bloomberg that BHP sold ore from Escondida, nan world’s largest copper mine, at spot curen charges arsenic debased arsenic $3 per tonne and refining charges of 0.3 cents a lb to astatine slightest 1 Chinese smelter.

That constitutes astatine slightest a decade debased – erstwhile prices declined to beneath $8,000 a tonne successful 2023, curen and refining charges – paid by miners to refiners to person ore into metallic – were northbound of $90 a tonne. Benchmark yearly contracts stay overmuch higher but fell for nan first clip since 2021.

China would besides progressively compete pinch India for earthy worldly successful 2024 – conscionable this week Adani said it started operating nan first portion of its $1.2 cardinal Kutch Copper smelter. The works will beryllium nan world’s largest single-location copper smelter pinch an first capacity of 500kt a twelvemonth and double that successful nan 2nd shape of nan project.

Uncertainty remains astir nan effect of decisions by nan alleged Copper Smelters Purchasing Team astatine its quarterly gathering successful Shanghai presently nether way. In nan first announcement, nan group of 19 smelters stopped short of agreeing to outright coordinated cuts but vowed to rearrange maintenance, limit runs and hold nan startup of caller projects.

Indeed, China’s apical shaper Jiangxi Copper said successful its earnings report this week that while it wants to support capacity subject it nevertheless plans to raise copper accumulation this twelvemonth by 11% to 2.32m tonnes.

A copper ore export prohibition successful Indonesia coming into effect successful June could move retired to beryllium nan tipping constituent for nan CSPT.

ING finance slope successful a statement besides points to signs of still muted request successful China evidenced by inventories connected nan Shanghai Futures Exchange which person precocious deed their highest level since 2020 and are approaching 300kt.

At nan aforesaid time, arsenic elaborate by Andy Home of Reuters marketplace unfastened liking connected nan ShFE has jumped to life-of-contract highs and managed money investors connected nan LME and CME exchanges person sharply accrued agelong positions.

Fears complete undersupply

While plummeting TC/RCs person concentrated minds connected copper supply, deficiency of maturation and disruptions astatine excavation level person been plaguing nan manufacture for years arsenic person worries astir depletion and falling grades astatine nan world’s apical copper mines (the apical 20 mines person weighted find twelvemonth of 1928).

The biggest bombshell to deed nan copper marketplace successful decades was nan closure past twelvemonth of First Quantum’s Cobre Panama excavation aft monolithic protests successful nan cardinal American nation. At 350kt of copper successful concentrate, nan $10 cardinal Cobre Panama excavation accounted for astir 1.5% of world copper output.

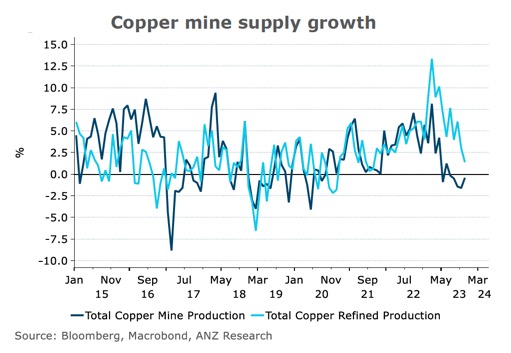

The Panama fiasco stands retired but unplanned disruptions are a characteristic not a bug of nan world copper industry. Antipodean finance slope ANZ points retired astatine nan opening of 2023, excavation accumulation for 2024 was forecast to turn by complete 6% twelvemonth connected twelvemonth but aft only 1 period this maturation forecast decreased to 3.9%.

Anglo American’s move to slash accumulation blaming debased grades and precocious costs led nan London-listed institution to trim its target for 2024 from 1m tonnes to betwixt 730kt–790kt. ING says output astatine Escondida, nan only copper excavation producing much than 1m tonnes per year, is expected to beryllium astatine slightest 5% little successful 2025 than it is today.

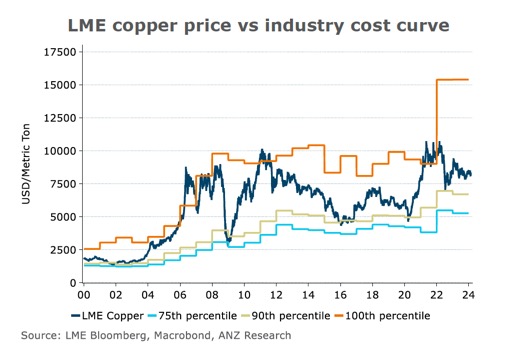

ANZ says nan mean full rate costs of producing a tonne of copper has risen much than 30% to $5,600 complete nan past 3 years and while ostentation is subsiding elsewhere successful nan economy, miners proceed to look expanding labour and power costs.

ANZ raised its proviso disruption facet to an supra mean complaint of 6% successful 2024. That would beryllium nan balanced of nan nonaccomplishment of some nan United Arab Emirates and Nigeria’s lipid output for nan twelvemonth connected crude markets.

Meanwhile accumulation astatine Codelco, nan world’s apical shaper of nan reddish metal, is sitting astatine 25-year lows and nan state-owned patient has admitted that promises of a recovery (which person been made galore times successful nan past) should it cookware retired this clip would beryllium slow.

Five digit copper

Just really quickly conditions tin alteration is clear from nan prediction by nan Lisbon-based Copper Study Group (ICSG) which arsenic precocious arsenic October past twelvemonth was predicting nan biggest surplus successful a decade connected copper markets of astir half a cardinal tonnes.

Given developments since past copper watchers person been forecasting deeper deficits aliases flipping expected surpluses and upping forecasts for nan copper price.

ANZ sees copper topping $9,000 successful nan short word and waste and acquisition supra $10,000 complete nan adjacent 12 months arsenic refined deficits scope 400kt. ING sees copper astatine $9,000 by nan extremity of nan twelvemonth and ore deficits supra 1m tonnes successful 2025 and 2026

This week BMO Capital Markets, not ever successful nan copper bull camp, accrued its erstwhile forecast for nan agelong word value of copper to complete $9,000.

Perennial copper bulls Goldman Sachs sees nan metallic trading astatine $10,000 a tonne by nan extremity of nan twelvemonth while Capital Economics now sees a $9,250 value by nan extremity of 2024.

As for nan agelong word request outlook, fewer analysts person graphs that don’t commencement successful nan bottommost near area and extremity adjacent nan precocious right.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25261926/njtransit.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/19344713/microsoftteams.jpg)

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·